Everything is changing so quickly. As a business owner, it can feel impossible to keep across it - let alone get in front of it!

To help, along with market researchers Ipsos MORI, we’ve taken a snapshot of what adults in the UK are thinking as pandemic restrictions continue to evolve. The insight will help you better position your business for the best recovery and growth.

We surveyed 1129 people online in the UK between May 28 and June 1, 2021. The respondents, aged 16-75, were asked about the payments methods they’ve started using, or have used more, as a result of the Covid-19 pandemic, and which of those they intend to continue as everyday life begins to settle down.

Our top line findings show that as a result of the pandemic:

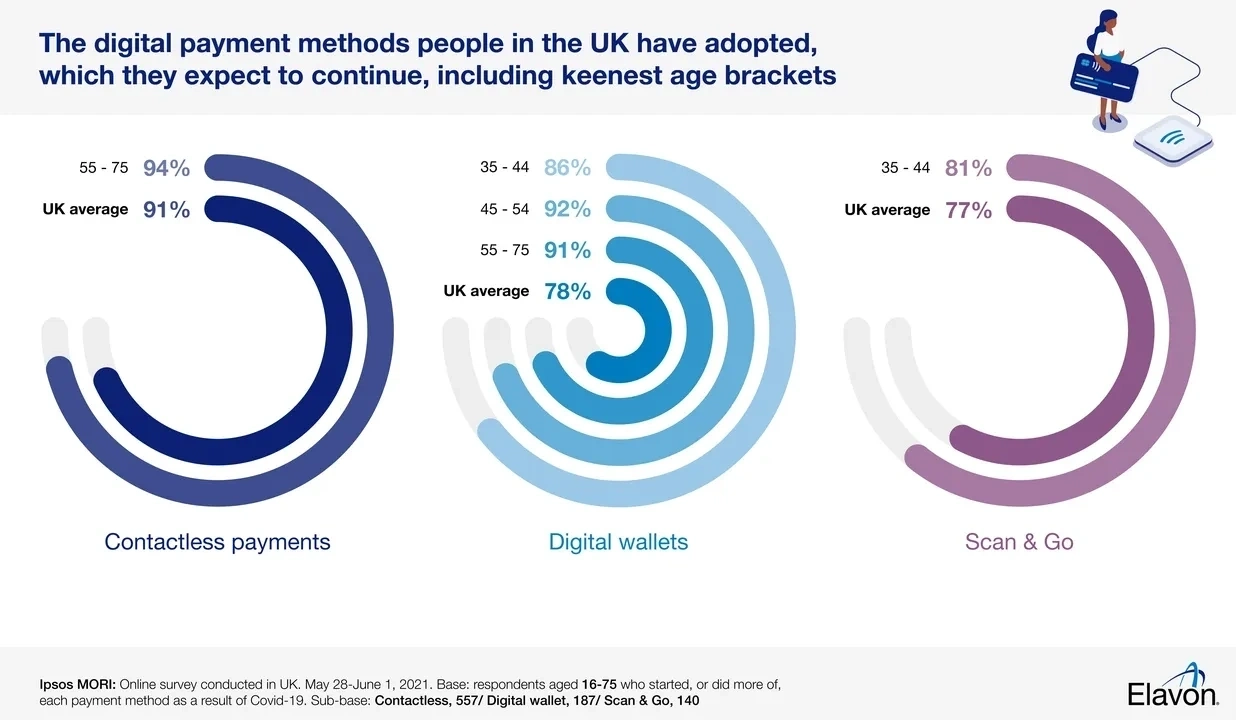

- 91% of those who started or increased their use of contactless payment methods, plan to continue using this method after restrictions have been lifted in the UK. With that rising to 94% when looking specifically at those aged 55-75.

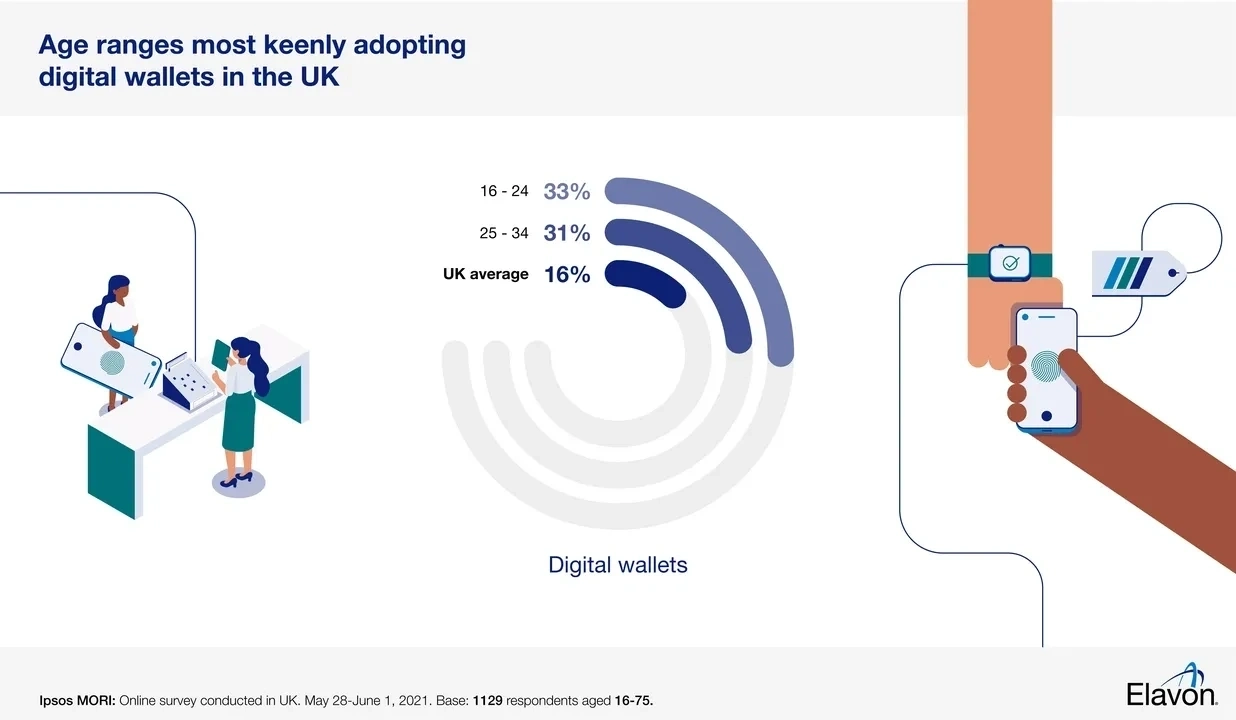

- Digital wallets emerge as a trend to watch. While 16% of respondents started using, or increased their use of, digital wallets, for those aged 16-24 it was more than double (33%), and just under double (31%) for those aged 25-34.

- Interestingly, when it comes to continuing the use of digital wallets after restrictions have been lifted in the UK, the keenest age groups are those aged 35-75. Rising from a 79% average across ages, to 86% for those aged 35-44, 92% for those aged 45-54 and 91% for those aged 55-75.

Read on for a deeper dive into our findings and what they mean for your business.

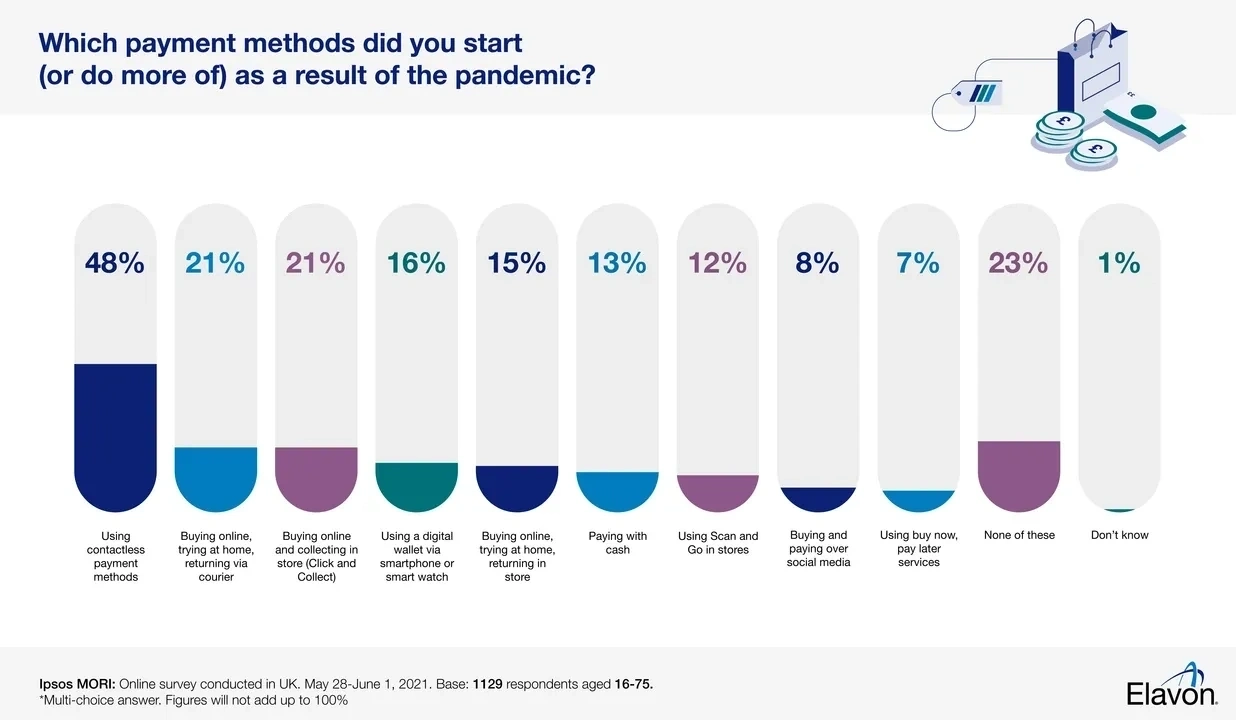

The payments methods we started or increased as a result of Covid-19

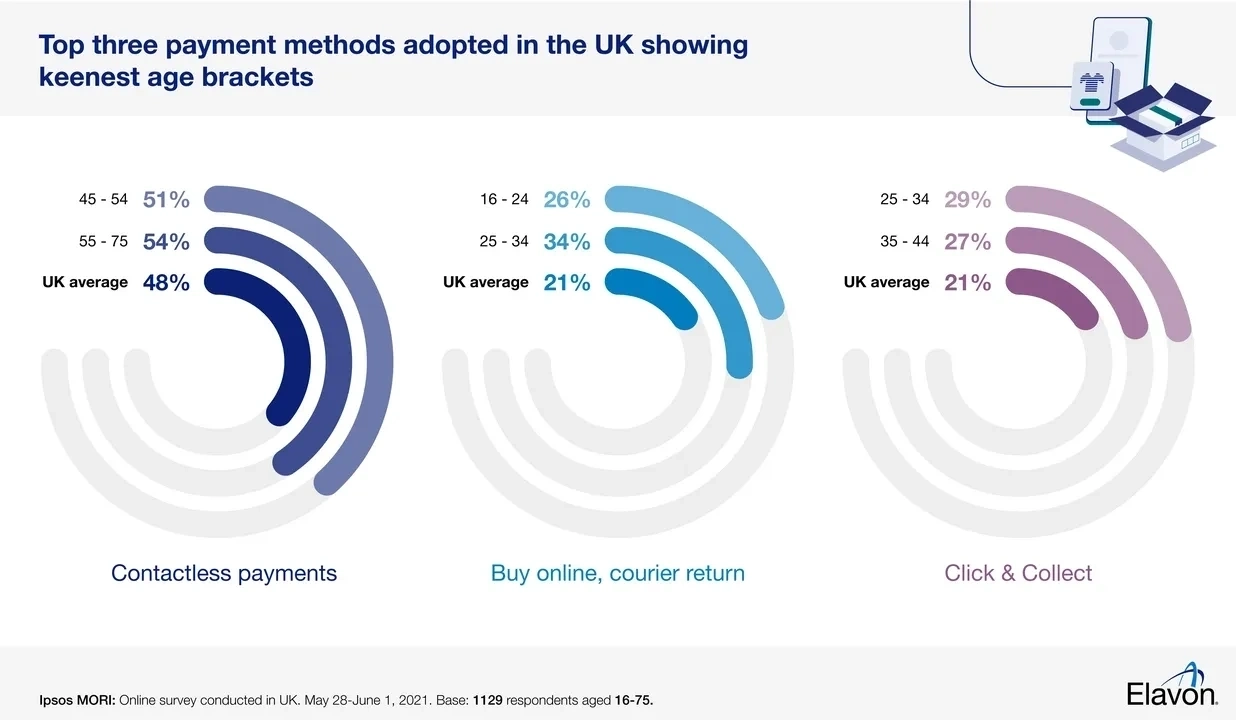

Almost half (48%) of adults said they started using contactless payment methods, or increased use of them, as a result of the Covid-19 pandemic.

Just over one in five (21%) took up using or increased their use of buying something online, trying it at home, and then returning it - if necessary - via a courier service. (As opposed to returning unwanted goods in store, which was the fifth most popular response (15%)).

21% also said they have taken up or increased their use of using Click and Collect services, which involves buying online and collecting in store. This is an example of omnicommerce - a hybrid of the online and in store consumer experience.

“Interestingly, the most popular payment methods being used show consumers are embracing the full range of payments types available: from face-to-face in store to online and omnicommerce,” says Simon Tune, Commercial Director for Elavon Europe. “This in itself offers reassurance that whatever business environment you’re operating in, your customers are accepting change and progression.”

Differing use of payment methods also highlight significant variations across age groups.

While those who started to use contactless payments as a result of Covid-19, or have used this payment method more, averaged 48% across adults, amongst our two most senior age brackets it was even higher: 51% for those aged 45-54, and 54% for those aged 55-75.

Buying online, with courier service returns of any unwanted goods, was a payment method more likely picked by the youngest two age groups. 21%, as an average across our respondents, rose to 26% for those aged 16-24, and 34% for those aged 25-34.

Click and Collect was most keenly started, or used more, by those in the age brackets 25-44. 29% for those aged 25-34, specifically, and 27% for those aged 35-44. This compared to an average of 21%.

Special attention should be directed at the increased use of digital wallets, especially for businesses targeting younger consumers. Digital wallets are payment apps such as Apple Pay or Paypal, to name just a couple, that can be used via smart devices (smartphones/smartwatches).

As an average, 16% of adults said they had started using digital wallets or used this payment method more. But uptake was almost double that (31%) for those aged 25-34, and just over double the average for adults aged 16-24 (33%).

Enduring payment methods

“Knowing which payment methods adults have adopted tells us where your business needs to be right now to satisfy your customers’ needs. But knowing which they will continue after the pandemic tells us where you need to be heading, if you aren’t already there,” says Simon.

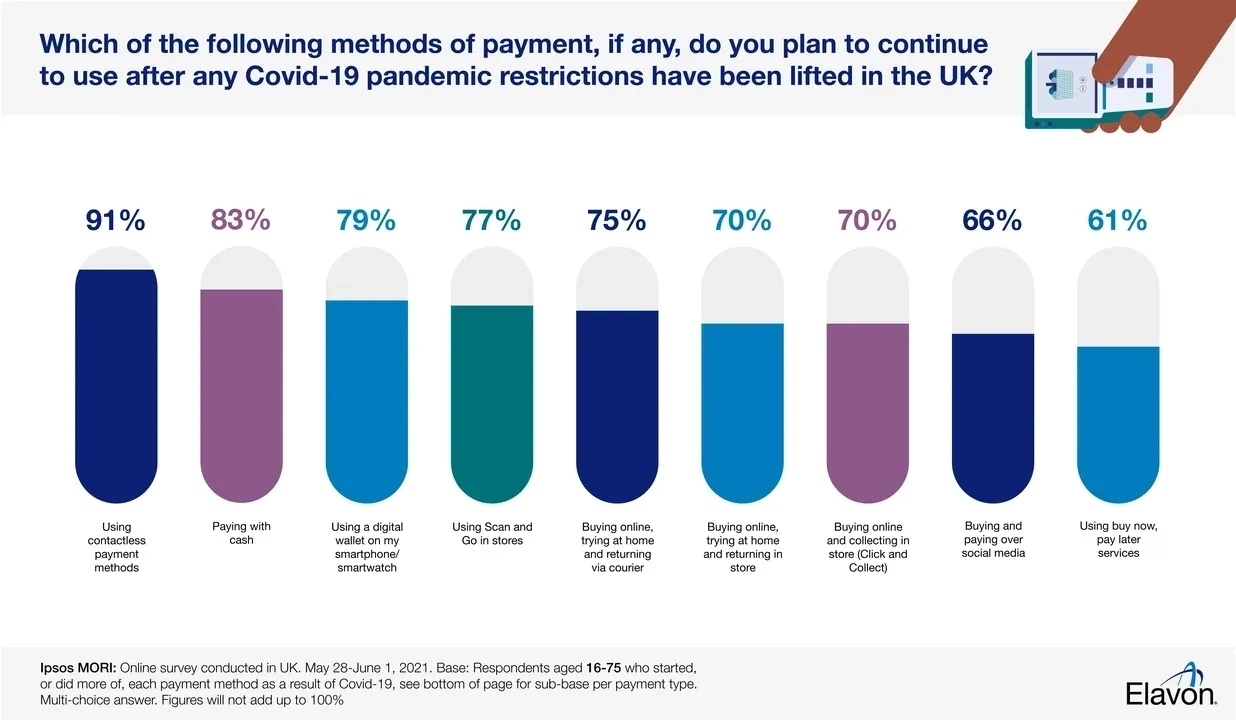

So once respondents had selected which payment methods they had started, or increased, as a result of the Covid-19 pandemic, we asked ‘which, if any, they planned to continue to use after pandemic restrictions lifted in the UK?’

Contactless

Of those who took up, or increased, the use of contactless payments, more than nine out of ten (91%) intend to keep using contactless payments in the future after any Covid-19 pandemic restrictions have been lifted in the UK.

But that already sizeable fraction and percentage increases to 94% for those aged 55-75.

“This appetite to continue using contactless payments demonstrates the strength of confidence consumers now place in transactions of this kind in the face to face payments journey. That’s not solely down to social distancing and the hygiene advantages of contactless, but also likely to be its convenience,” says Simon.

“If you have not been supporting your customers by offering contactless payments, you can see now there’s a genuine demand being driven by consumers - particularly in adults aged over 35.”

Digital wallets

Digital wallets, because of their nature, work in all consumer payment environments from face to face and unattended, to online and omnicommerce. They also emerge as a trend that’s had an impact on every age group. While those starting, or increasing, their use of this payment method as a result of the pandemic averaged 16% among respondents, it was around twice as popular with those under 35. 33% for 16-24 and 31% for those aged 25-34.

But when it comes to continuing the use of digital wallets after restrictions have lifted in the UK, the keenest age groups are those aged 35-75.

As an average across age groups, almost four out of five (79%) of those who started or increased their use of digital wallets intend to continue using them. But that average rises to 86% for those aged 35-44, 92% for those aged 45-54 and 91% for those aged 55-75.

Scan and Go

Scan and Go is an example of unattended payments and has most prominently been seen in supermarkets, where – during the pandemic – the ability to scan items as you shop, and pay without contact at a till, has been supporting social distancing and hygiene protocols.

Scan and Go was not in the top three digital payment methods when it came to the percentage of respondents who said they started, or increased, use of it (12%) because of the pandemic. However, when it comes to those payments methods UK adults say they’ll continue after restrictions are lifted, it makes the podium – in third place. Just over three quarters (77%) of those who took up, or deepened, their use of it say they will continue using it once the pandemic restrictions lift.

Paying with cash

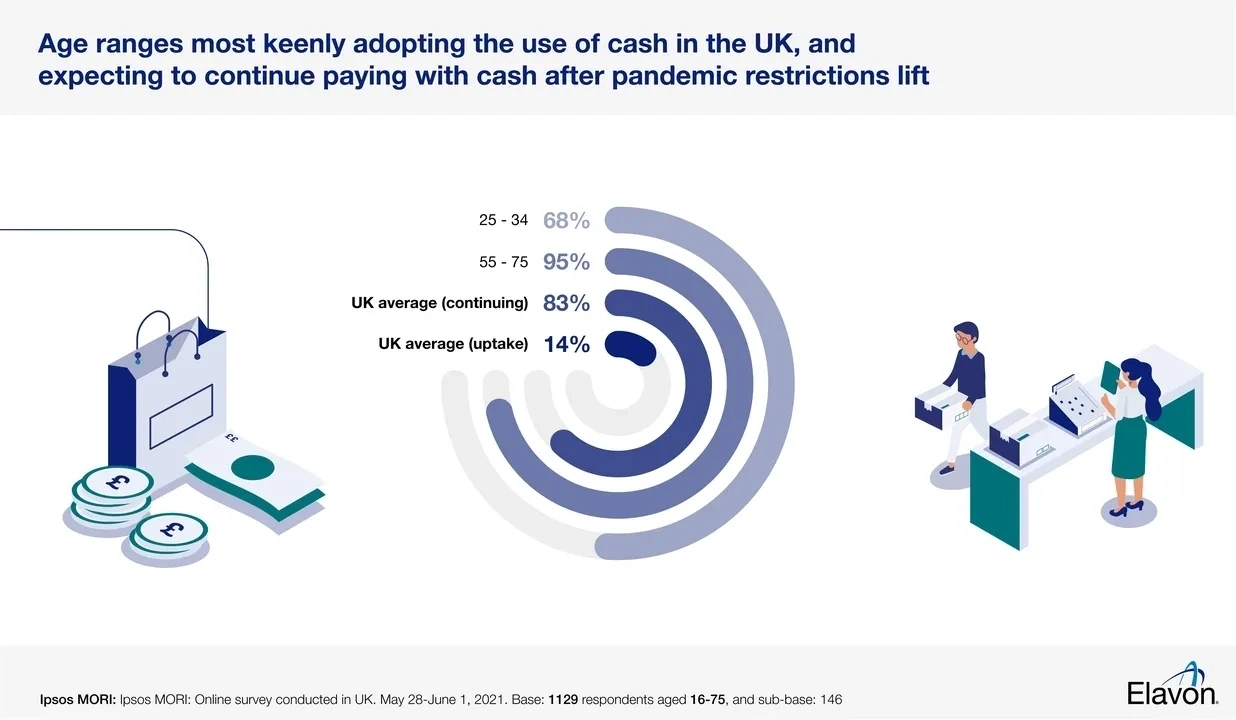

While over one in ten (14%) of adults said they had started using, or increased their use of, cash because of the pandemic, more than four out of five (83%) of those that did so said they would continue using it after the pandemic restrictions are lifted. That average for continuing the use of cash varies wildly between age groups – dipping to 68% for those aged 25-34 and up to 95% for those aged 55-75.

“This shows the importance that notes and coins still play in our economy,” says Simon. “But while it whispers to the volumes of consumers who still rely on cash, it should speak loudly to financial institutions and regulators about the vital need to make access to bank accounts easier and more inclusive. How many, who cannot access digital payments, are in that position because they’re unable or unwilling to use a bank account?”

We commissioned this same survey in other countries too, which may interest you:

We asked these same questions to 1000 adults in Ireland and 1086 adults in Poland.

The research was conducted on i:omnibus, Ipsos MORI’s online Omnibus.

- Online interviews were carried out amongst adults aged 16-75 in the UK.

- Our total respondents base includes 1,129 adults who completed the survey 28th May-1st June 2021.

- Our sub-base for those who started, or used more of, a payment method as a result of the Covid-19 pandemic includes 859 adults, also completing the survey May 28-June 1, 2021

- Our sub-base for adults aged 16-75 in UK who started using each payment method, or used it more, as a result of the Covid-19 pandemic are as following: Contactless n=557; Digital wallet = 187; Click & collect n=242 ; Buy online, try at home and return via courier service n=241; Buy online, try at home and return via store n=158; Cash payments n=146; Buy now, pay later n=81; Scan & Go n=140; Buying and paying on social media n=86.

- The sample obtained is representative of this population, having met quotas on: age, gender, region and working status.

- The data has been weighted to the known population profile by age within gender, region, education, working status and social grade to be nationally representative and reflect the adult population of the UK.